Table Of Content

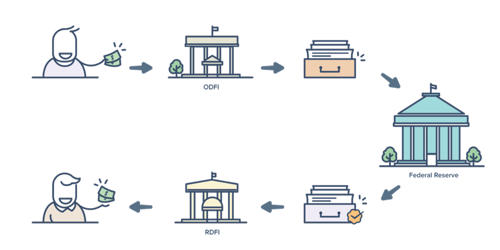

NACHA rules state that the average ACH debit transaction settles within one business day, and the average ACH credit transaction settles within one to two business days. Payments are set up at the originating bank as a debit or credit ACH transaction. These are batched together and processed using the ACH system at regular intervals throughout the day. By batching transactions, the clearing house can manage them more efficiently for reduced processing times. Furthermore, ACH transfers serve as a cheaper option for individuals to move money from one place to another through direct deposit or e-transfer. As no material resources are being utilized, such as envelopes, ink, stamps, printers, etc., there is a reduced amount of paper and pulp used since the entire transaction is online.

Contents

For a complete listing of the FTB’s official Spanish pages, visit La página principal en español (Spanish home page). This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Once you choose an option, you must complete the Authorization Agreement for Electronic Funds Transfer (FTB 3815). Once entitled, users can access CitiDirect-ACH using their CitiDirect log in credentials. To preemptively reduce your exposure to fraud, Citi administers and manages an ACH Debit Block service that automatically returns all ACH Debits, preventing them from posting to your account. Signing up for ACH procedures differ slightly for ACH debit, credit and refund.

The power to pay virtually

Merchants often enable consumers to pay bills via ACH by providing an account number and bank routing number. A number of online payment services also conduct transactions via ACH, including most banks and credit unions’ online bill payment services. An ACH transfer is an electronic money transfer between banks or credit unions through the Automated Clearing House network. ACH payments and transfers include external funds transfers, person-to-person payments, bill payments and direct deposits from employers and government benefit programs. The U.S. payment landscape is going through significant transformation.

Do ACH Payments Cost Consumers Money?

However, a CTX coming from a corporate account can support up to 9,999 addenda records. Corporate Trade Exchanges are generally used in partner trading correspondence. A CCD entry is either a single-entry, recurring ACH credit, or recurring ACH debit from a corporate account. Before any entity can participate in ACH transactions, they must complete account authorization. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

There may be a cutoff time by which you need to get your transfer in to have it processed for the next business day. ACH transfers have many uses and can be more cost-efficient and user-friendly than writing checks or paying with a credit or debit card. The network is updated to allow businesses and individuals to execute transactions on the same day.

NACHA Rule Changes – Effective June 21, 2024

Some bank customers still can't get their paychecks as direct-deposit woes persist - CBS News

Some bank customers still can't get their paychecks as direct-deposit woes persist.

Posted: Tue, 07 Nov 2023 08:00:00 GMT [source]

We're the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly. ACH transactions can trigger a return notification if there are insufficient funds in the account. The Board and Reserve Banks provided comment on Nacha's December 1, 2017 request for comment on proposed rules to expand same-day ACH. These regulations define the rights and liabilities of everyone involved with ACH. They cover ACH credit entries, debit entries, and data that agencies send or receive through ACH.

ACH Regulations (31 CFR Part

Since reconciling your account(s) daily is advisable but may not always be possible, Citi recommends that clients implement an ACH debit block on their U.S. Although the majority of ACH transactions are legitimate, an ACH debit block can help reduce the potential for unauthorized, fraudulent and/or erroneous ACH debits. Citi's ACH Debit Filter service enables you to create, maintain and update Electronic Payment Authorizations (EPA) to filter and identify ACH Debit transactions that are approved to post to your account. Users can create, change, and delete Electronic Payment Authorizations for all accounts set up with ACH Debit Block.

By using the Portal, ACH Network participants can help enhance ACH Network quality and security, fueling innovation and the continued growth of the ACH Network. These changes will amend the Rules to address a variety of minor topics. Minor changes to the Rules are expected to have little-to-no impact on ACH participants and no significant processing or financial impact. Empathy-based leadership is increasingly recognized as a valuable approach in the business world, where traditional strategic plans often fall short. The best businesses focus their customer experience programs on doing the things that delight customers and put them ahead of their competition. Last year 29.1 billion payments adding up to $72.6 trillion, were reported by the National Automated Clearing House Association (NACHA).

With options including same day and next day settlement, ACH is trusted by businesses, governments and consumers to get funds where they need to be, when they need to be. ACH transactions were initially transmitted to the Fed through physical media, primarily magnetic tapes and later floppy disks. One magnetic tape could contain payment information equivalent to 1.5 million checks (McKelvey 1976). Banks delivered these media to Federal Reserve Banks along with other deliveries such as paper checks or currency (Board of Governors 1976). Given the somewhat cumbersome nature of magnetic tapes, at the time ACH payments were best suited for routine payments such as payrolls or monthly consumer bills that could be prepared in advance.

Certain banks limit the amount of money you can transfer through the system, so if you want to transfer large amounts of money to other people, you may have to do so through multiple transactions. The ACH Network is an electronic system that serves financial institutions to facilitate financial transactions in the U.S. ACH transactions totaled more than $80.1 trillion in 2023 by enabling over 31.5 billion electronic financial transactions.

You can also use Zelle, a payment app that works directly with hundreds of banks and credit unions. Zelle delivers money to the recipient right away and the transfer is finalized later through normal ACH processing or in real time if the bank uses the RTP network, a real-time payment system. An ACH transfer is one of the main ways to send or receive money online. ACH, or Automated Clearing House, transfers account for the online bill payments you make and the direct deposits you receive, along with other transfers. The ACH Network, or Automated Clearing House network, is a system in which funds are electronically transferred from one party to another.

The organization's operating rules are designed to facilitate growth in the size and scope of electronic payments within the network. If you need proof of payment, contact your financial institution to obtain proof and verify funds were transferred from your account to the State’s account. If you are making payments to more than one California state department, note that each department has its own bank account number and requires different information. Automatically accept authorized transactions from trading partners, decide whether to pay or return ACH exceptions in real-time, and update your ACH authorizations. Exceptions that require either primary or secondary approval, or both, can also be approved using your mobile device.

No comments:

Post a Comment